Israeli Startup Investments in 2025: AI Everywhere, Revenue Optional

- Niv Nissenson

- 6 days ago

- 2 min read

I attended a recent presentation by Dudi David Fruchtman and Gideon Shalom Bendor (Meitar and IBI S Cube) offered a revealing snapshot of where Israeli startup investment is heading in 2025 and the story is overwhelmingly about AI, scale, and valuation expansion.

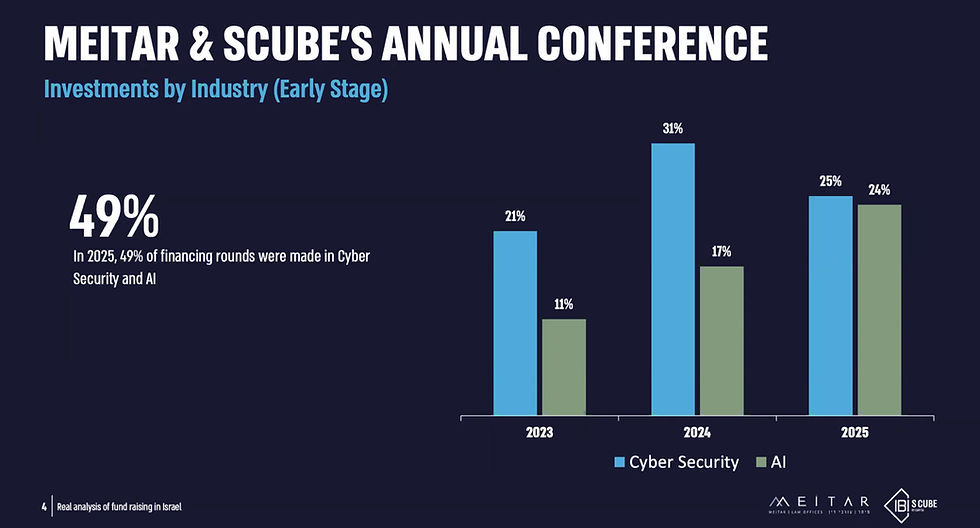

AI (and Cyber) Dominate Early-Stage Investment

In 2025, AI and cybersecurity accounted for roughly 49% of all early-stage investments in Israel. What’s notable isn’t just the size of that share, but where Israeli startups are playing. Unlike the U.S., which still invests heavily in AI infrastructure, Israel is far more focused on AI applications and vertical solutions.

For comparison, AI and cyber represent about 60% of early-stage investment in the U.S., but with more weight toward platforms and infrastructure.

Scaling with AI

One clear investor expectation emerged: AI is now seen as a scaling mechanism, not hiring. Growth stories increasingly assume automation, not people, as the engine. That shift is pulling valuations higher — and with them, both capital invested and performance expectations.

Valuations are surging, especially in later stages

The data showed a remarkable increase in late-stage valuations and round sizes, with Israel seeing a record-high median Series B valuation. In the U.S., the trend is even more extreme: half of Series C rounds exceeded $500M, underscoring how capital is concentrating around perceived category leaders.

IPO Markets are hot — profitability isn't as important as in the past

Global equity markets are strong, and the IPO window is wide open. Over 300 IPOs took place in the US, compared with just a handful in Israel. Strikingly, 48% of U.S. IPOs were unprofitable, reinforcing the idea that public markets are still pricing potential over earnings.

As Fruchtman put it, Israeli high-tech remains more focused on potential than revenue, in contrast to the U.S., where sales traction plays a larger role earlier on.

Structural Shifts in Israeli Tech

Two additional trends stood out:

Incorporation is moving abroad: only 52% of Israeli startups are now incorporated in Israel, down from ~80% historically.

Rounds are overwhelmingly up rounds: 81% up rounds, just 5% down rounds, with the remainder flat — a sign of a strong founder-favorable market.

It's clear that is Israel has been doing remarkable well despite the war and has maintained or even enhanced it's position as a global AI and Cyber powerhouse.